2010-09-30_0722YM

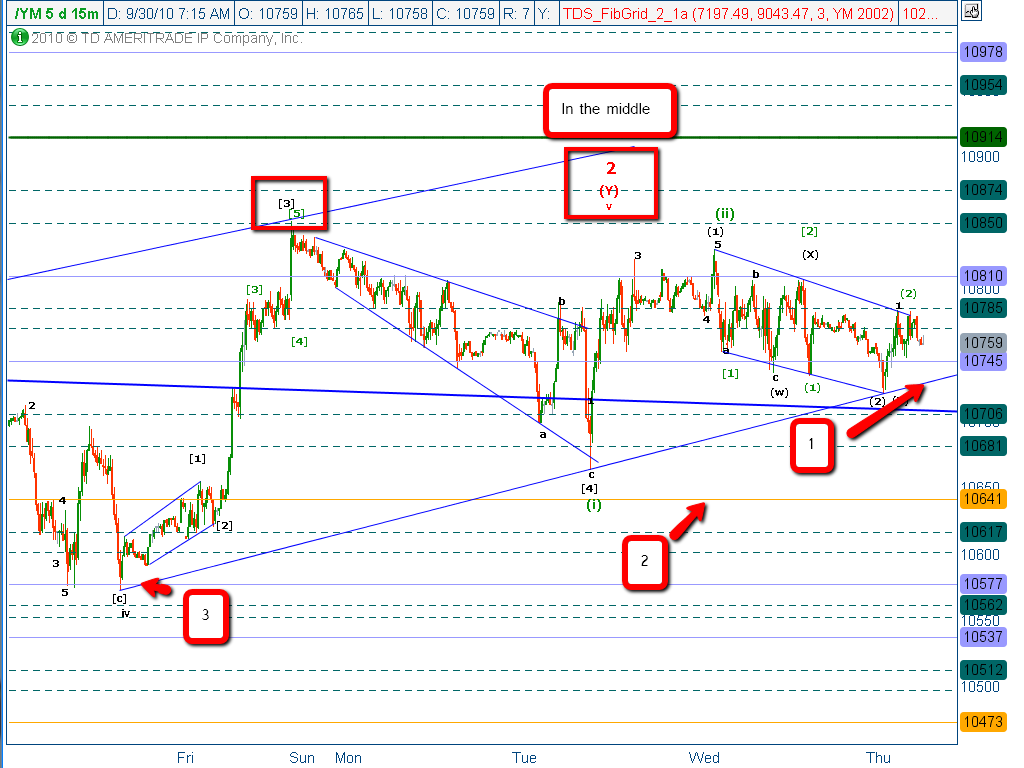

Stuck in the middle of nowhere seems to capture the market zeitgeist of the past few days. Overnight actions haven’t resolved the indecision evident in the wave structure. Our views of the YM mirror our comments of the DJIA, the underlying cash instrument. Sometimes the overnight futures markets telegraph daytime moves and. So far this morning it has only signaled that it is waiting just like everyone else. The moves haven’t closed off any options, so it doesn’t help us predict market moves on this particular day. Nevertheless, the count still suggests that we are very close to finishing the end of intermediate wave 2, perhaps with one more wave up in an ending diagonal wave v, or perhaps wave 2 finished at Sunday night’s opening. The jury is still out, but it’s taking them a long time; I’m starting to get images of “12 Angry Men.”

Our YM chart also offers the same alternate counts as on the DJIA. Instead of black and white our labels are black and green, with wave 2 in red. A solid break of the lower trend line will be our first clue that perhaps the the high is in. An intermediate clue would be to see price break through the FibGrid snow line with volume and momentum and hold below that level on any retest. Final confirmation would be indicated with prices falling below the wave iv low. A move above 10,850 would indicate that perhaps one final thrust was needed to complete the pattern.

As we said in our last evenings update, Employment numbers and the revision of the Q2 GDP numbers at 8:30 may provide the first clues as to which direction the market will move today.