Squawk Morning Briefing: Slightly Less Precious Metals

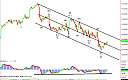

Overnight silver futures continued selling off and gold returned to test Tuesday afternoon lows. Both display the characteristics of an impulsive decline with five waves clearly visible in the silver chart. While it is premature to call a turn down in either metal, there is a strong case to be made that we are seeing […]

Squawk Morning Briefing: IBM Pop

Well-received earnings from IBM have pushed equity futures higher. This fits well with our expectations for a turn higher in equities, but we still need confirmation before declaring that the move has started and won’t begin from lower levels. Updated key levels and signs we’ll look to for confirmation are in today’s videos.

Squawk Morning Briefing: Still Waiting for Range Break

With most markets we track still stuck in the middle of ranges that appear corrective, there is little new to say today, but we update our outlook in our videos and set the stage for what we’ll look for when those ranges are broken.

Squawk Morning Briefing: Wide Chop Range

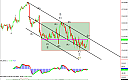

After a drop at the open on Monday, U. S. equities stayed in a wide range throughout the week. markets were clearly in a negative feedback pattern, where attempted breaks in either direction were met with forceful opposition. Within our Elliott wave framework, this coincides with corrective action and we’re waiting to see how the […]

Squawk Morning Briefing: Break Time

We’re still waiting for the markets to exit chop mode and enter trend mode and it feels like a good time for a break. Kevin will be doing just that, so starting tomorrow David will be filling in through the end of next week. Today’s videos (still from both David and Kevin) update our current […]

Squawk Morning Briefing: Debt’s All Folks

With apologies to Porky Pig, today we start with the observation that debt seems to be moving the markets. Alcoa earnings did little to alter the direction of markets yesterday and saw mostly chop through the morning. The release of FOMC minutes started to move things in the afternoon as some interpreted the Fed’s position […]

Squawk Morning Briefing: Staying on Track

U. S. Equities and the Euro are continuing to trace out moves consistent with the scenarios we’ve been watching so today’s videos update those scenarios and refine them, including new key levels, but no significant changes. Treasuries needed an adjustment based on overnight strength and we address that also, but we continue to look for […]

Squawk Morning Briefing: From Jobs to Earnings to OpEx

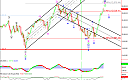

Friday’s move was an example of something we talk about frequently. Earnings can move the markets, but usually it is a catalyst for pushing things in whatever direction would be expected or allowed by the current wave structure. In the case of the DJIA, we were looking for a turn down into a wave iv […]

Squawk Morning Briefing: High Hopes

The talking heads all sound optimistic about the BLS report due in a few minutes after yesterday’s positive ADP report. Additionally, we don’t seem to be alone in our view that markets may be heading for a new high since equities continued their strength yesterday pushing harder toward the May 2nd top. The path there […]

Squawk Morning Briefing: I’m Too Sexy For This Risk

The monthly ADP report came out a few minutes after we finished recording our videos and +157,000 was enough to signal risk off — for the moment at least. Stock futures soared and treasury futures tumbled. The Euro did little as it already was continuing to move in the risk-off direction following the monthly ECB […]