Squawk Morning Briefing: Disappointed Fed Doesn’t Disappoint

In its written statement and in comments by Chairman Bernanke, the Fed expressed disappointment at the pace of the U.S. recovery. Even though they expressed their belief that many for the drags on GDP would be temporary they lowered their 2011 and 2012 forecasts. Once again, the FOMC came through and delivered what many traders […]

Squawk Morning Brieifing: FOMC Day

Traders in bond, equity, and currency markets are all watching for some sign from the Federal Reserve so the results of today’s meeting and the press conference that follows may introduce some volatility. We want to see if that moves that follow help to clarify our wave counts. We’ll get straight to the videos to […]

Squawk Morning Briefing: Testing, 1, 2, 3…

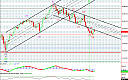

With a three-day old bounce in the works for the DJIA, we are seeing our first real test of our various wave count possibilities we are tracking. At this point, is is important to see the structure of the rise (is it in five waves or three) and the extent of the rise and what […]

Squawk Morning Briefing: The “New Normal”

With options expiration week over, along with it’s historically positive bias, perhaps we can return to “normal.” Of course that begs the question of what’s normal. Is it the string of six weekly declines in U. S. equities that preceded expiration week? Perhaps it’s the fact that Equities continue to resist committing to a direction.

We […]

Squawk Morning Briefing: Opex Games Again

Options expiration is upon us again. And with wave counts up in the air, we don’t really have a guide to help us sort out any potentially wild moves if they should occur. It’s a great day to sit and watch if you really have to track the markets. If you don’t need to watch, […]

Squawk Morning Briefing: Flight To Safety

Earlier in the week we mentioned the special impact that we anticipate from regional Fed surveys and the Empire State survey on Wednesday packed a double whammy. No only did it confirm weak reading last month, but it surprised almost everyone by contracting.

Of course, we always say that we care about the reaction, and the […]

Squawk Morning Briefing: Important Webinar Update

We hope that subscribers will join us for our webinar today. Unfortunate, the setup had problems so even if you had previously registered we need to ask you to register again at the link below. Remember, there’s no set agenda so come to talk about whatever aspects of wave theory or the Squawk service that […]

Squawk Morning Briefing: Market Concerns

We care about market concerns because they tell us which news events deserve more attention. As always, we care more about when to expect movement and the reaction to the report than the report itself. Any report can move markets if there’s enough surprise, but there are ones which we can anticipate to be important […]

Squawk Morning Briefing: Eyes on China

There isn’t anything on the U. S. news docket today, but we’re expecting plenty of news out of China overnight and it could move markets. Last night brought reports that Chinese lending was down much more than expected as government curbs are proving more effective than economists predicted. So now the question is whether it […]

Squawk Morning Briefing: Looking for Higher Probability

The U. S. equity markets continue to leave themselves open to multiple interpretations from an Elliott wave perspective. Therefore, we want to avoid making large commitments until there are higher probability setups. We will continue to watch these every day to be prepared for a time when the patterns point more clearly in a single […]