Archive for the ‘Morning Briefing’ Category

Squawk Morning Briefing: Why Go Out on a Limb?

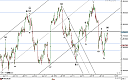

We mentioned in last night’s DJIA briefing that the intraday decline in blue chip equities was still consistent with a fourth wave correction. In some ways this felt like going out on a limb. After all, small caps and the Dow Transports were off about 2%. If this is the turn, then […]

Squawk Morning Briefing: Calm Before The Storm?

Monday’s trade saw an NR7 day — meaning it was the narrowest trading range over the preceding seven days. Often this announces the possibility of an upcoming explosive move, but instead we saw an even narrower range on Tuesday. That gave us an NR7-2 which many see as an even stronger signal. […]

Squawk Morning Briefing: We Have Been Here Before

Today’s situation is nothing new. We expect that we are in a correction but uncertain about the exact structure or where it will end. Our latest thoughts are in today’s videos.

Squawk Morning Briefing: Will This Rally Last?

The U. S. equity rally since June 4th seems to persistently avoid breaking down. Does this mean that markets are heading up instead? As we discuss in today’s briefings, the odds still suggest that the answer is no. The move up still appears corrective, especially when viewed alongside the preceding decline which […]

Squawk Morning Briefing: All About GDP

For those watching the DJIA, CVX is the earnings announcement to watch. Since it sports the second highest share price in the DJIA, a 1% move in CVX has the second greatest impact on the index — about 8 points. That is only shy of IBM which moves the DJIA more […]

Squawk Morning Briefing: Second Tier Earnings

This morning’s earnings docket has three DJIA components: MMM, UTX, and XOM. While none trade over $100 a share like CVX and DJIA big dog IBM, they are just below those levels with $70s and $80s. That means they still have a lot of pull in the price-weighted DJIA. It […]

Squawk Morning Briefing: Earnings Whip

A poor reaction to earnings Tuesday evening followed by welcome reports Wednesday morning has taken the equity futures on a pretty wild ride down then up. For the cash indices it will likely only be seen as a bounce and, once again, that will have us looking at the potential of the futures […]

Squawk Morning Briefing: Mixed Bag of Earnings

We have a big flood of earnings out this morning including DJIA components DD, which missed estimates, and T, which beat consensus. This is somewhat representative of the overall earnings picture which seems to be a mixed bag.

At first glance the results from T seem to be better than most as it […]

Squawk Morning Briefing: Evidence Mounting

Overnight action is extremely weak and that has bearish implications on the futures charts and ones which will likely be echoed by the cash indices once they open. While we’re still above swing lows from July 12th and June 28th, The selloff is indicative of more impulsive action that increases the odds that we […]

Squawk Morning Briefing: Tricky Day?

We continue looking for a turn, but there are many possibilities for where and when it could show itself. Today’s videos contain our latest view, but we just want to point out that today is monthly options expiration in addition to being a day with a good sized slate of earnings so it could […]