Archive for the ‘Morning Briefing’ Category

Squawk Morning Briefing: Spring Feast

It already feels like Summer for many of us on the East coast. However, just like many recent short-lived selling steaks in the market, this weather may not last long. April will be upon us soon in any case and that’s usually a chance for family and friends to gather together and […]

Squawk Morning Briefing: Potential

Our equity index and Euro videos this morning contemplate the potential that markets could be turning down from current levels. With equity futures and currencies moving sharply as European trading opened markets have been put in a position where we can seriously watch for this possibility. However, we still need to […]

Squawk Morning Briefing: Relief

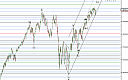

Both bull and bear markets eventually need to rest. In the context of Elliott waves we refer to these are our corrections and they are an opportunity for markets to work off overbought and oversold conditions before resuming a trend move. There can be a number of technical indicators which can hint that […]

Squawk Morning Briefing: The Worst Day

March 20th holds a special distinction in the record books. Historically, the DJIA is positive only 25% of the time on this date — worse than any other day. Does that mean we’ll close down today? Of course not! Beyond the fact that 25% of the observations closed positive, there is no reason to believe […]

Squawk Morning briefing: Is The Apple Tastier Peeled?

Friday’s quadruple witching was able to avoid the violent swings which are sometimes observed. It was a two-way market with a gap up to open and then a trend down. The market was able to accommodate unwinding of differently positioned holders of more institutional products at the open and more retail products at the close

This […]

Squawk Morning Briefing: Quadruple Witching

Quarterly expirations have the potential to be a bit more volatile than other months as we’ve noted before. Not only do index futures stop trading, but we also have many index ETFs which go ex-dividend. Furthermore, since index futures and options settle based on the opening print, there is the potential for […]

Squawk Morning Briefing: The Ides of March

The ides of March are upon us. We can’t say exactly who, if anyone, should beware. We also can’t say what they should be fearful of. However, we know that there remain warning signs beneath the surface and wave counts that are potentially near important turning points. So it […]

Squawk Morning Briefing: The Morning After

The major indices rose to new recovery highs on Tuesday and today our videos discuss the important elements we’ll be monitoring as we evaluate the wave structure going forward.

Squawk Morning Briefing: Fill ‘Er Up with High Test

On Monday, the DJIA closed just under 100 points off the late February high. As of this writing at about 8:00 Eastern, futures are at a level which would a cash open back above 13,000 and within striking distance of the prior high. This has been a possibility we have been considering as the decline […]

Squawk Morning Briefing: Decision Time

Imagine that a man and the love of his life had been discussing marriage for some time and he finally proposes. Yet the woman’s response is to say she needs to decide if the time is right. This may be a good analogy for the situation in markets right now. We […]