Archive for the ‘Morning Briefing’ Category

Squawk Morning Briefing: Substitutions

Kevin is back today, but he is substituting an ES briefing this morning for YM due to data feed issues. Otherwise we’re mostly back to normal but we’ll get right to the individual briefings on this eventful day. Equities have already popped since our videos were recorded and the Euro continues it’s […]

Squawk Morning Briefing: Trend Revisited

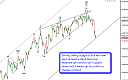

It is worth reviewing our comments from yesterday as they are central to how we use Elliot waves to interpret the actions of markets.

In our view, the most significant observations of R. N Elliott is that trend moves occur in five waves and counter-trend moves arrive mostly as three-wave moves. The group of rules and […]

Squawk Morning Briefing: Finding Trend

In our view, the most significant observations of R. N Elliott is that trend moves occur in five waves and counter-trend moves arrive mostly as three-wave moves. The group of rules and observations which we call our Elliott wave framework sometimes lets us pinpoint high probability turns and identify useful trading targets. […]

Squawk Morning Briefing: Risk Aversion

Last week’s LTRO operation in Europe saw a larger injection of capital into European banks than many were expecting. With it came the expectation on the part of some traders that it would lead to the same sort of asset inflation which accompanied quantitative easing in the U. S. However, last night brought the news […]

Squawk Morning Briefing: Economic Data Returns to Fore

Overnight we saw growth forecast in China and services PMI in Europe come in weak. We’ll get our own ISM services data at 10:00 Eastern along with Factory Orders. That kicks off jobs week and the typical string of reports that leads up to Friday’s report of the monthly BLS report.

Under the hood, many indications […]

Squawk Morning Briefing: TGIF

We remain in the same pattern we have seen for many weeks now. At some point we just become thankful that the weekend is upon us and we get a few days of rest. We’ll get right to the videos which update the latest outlook and be back on Monday to […]

Squawk Morning Briefing: Remain Patient; Remain Vigilant

When waiting for a a decline in a continued move up, a 53 point decline like was seen in the DJIA on Wednesday can make it seem like the long-awaited reversal has arrived. This is especially true when it comes with a reversal off the highs that is more than 100 points. While it could […]

Squawk Morning Briefing: Leap Frog? Bullfrog?

It is leap day and the slow, weakening grind up continues. Today sees extra liquidity in the form of a massive European debt injection and, perhaps, some month-end cash for fund managers to play with. Perhaps that is the fuel bulls need to play leap frog with stocks other than AAPL. Otherwise, the slow grind […]

Squawk Morning Briefing: Moves Meaning Nothing

Markets reacted even when S&P downgraded Greece to CC. Yet hardly a blip yesterday when they were downgraded to selective default. Why? The rational answer is that it no longer matters. S&P’s concern is reflecting the probability that the bonds won’t pay. That situation is now certainty and all participants now likely know what they […]

Squawk Morning Briefing: Will You Still Save Me Tomorrow?

With Greece saved, markets maintained an uptrend last week. The move continues to appear weak for all the reasons we have cited, but a trend is a trend until it isn’t. So that doesn’t mean that the market needs good news in order to retain its current direction, but it does cause us […]