Archive for the ‘Morning Briefing’ Category

Squawk Morning Briefing: Slowly I Turn…

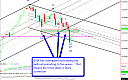

In our seemingly endless series of writings on Elliott waves and market tops, today we will once again mention that we seem to be observing topping action. One of the hallmarks is three-wave movement in both directions after an extended run. However, we will also once again caution that topping action does not mean that […]

Squawk Morning Briefing: Sloppy Action Continues

While our most likely case for the DJIA is to look for more highs, the sloppy action we continue to see suggests that it could be a choppy move to new highs. That means that even if we do get the new high, it doesn’t feel like a high probability trade. Add to that the […]

Squawk Morning Briefing: Videos and Voices

David’s voice isn’t back 100%, but good enough to record videos again so we have videos from both David and Kevin again today.

Squawk Morning Briefing: Look to Bonds

There remains plenty of uncertainty to shake out in the equity markets, but the treasuries are looking like they have a better trade setting up. Check it out in today’s briefing.

Squawk Morning Briefing: Don’t Compound Pain

It is painful to the market move and not take part in it. Wednesday’s action seems to increase the odds that U. S. equities will see another high before any turn. However, it’s also a good bet that it won’t be a straight path and we’re likely to remain in a choppy environment where the […]

Squawk Morning Briefing: Faulty Memory

The past couple of weeks have seen some pretty significant day-to-day reversals with traders seemingly losing any conviction they might have had the day before. For some time this had us considering some triangle counts and even though those counts are no longer valid, we still see some wild swings that create wave overlap in […]

Squawk Morning Briefing: What’s the Alternative?

Our analysis will often produce multiple count alternatives and we try to present the likely ones as part of our briefings. These aren’t to cover ourselves in case we’re wrong; rather, we think they present valuable information that traders should be aware of. Today’s DJIA briefing discusses the importance of these alternate counts.

On a related […]

Squawk Morning Briefing: Sitting Bulls Last Stand?

We continue to have many different count possibilities for equities. What most of them have in common is that most suggest we’re still going to new highs, and most suggest that the move is running out of steam. Whether its a triangle count that implies the next move will be the last, or an ending […]

Squawk Morning Briefing: Housekeeping Items

A few newsletter details to get out of the way: David is temporarily excused from jury duty so we’re on our regular publishing schedule but he’s still under the weather so Kevin is filling in with a combined update on the DJIA and YM while the Euro update is still a charts and text briefing.

European […]

Squawk Morning Briefing: Down for the Count

David continues to be ill this morning and has reverted to text updates with charts today rather than speaking on video. Kevin has video updates today. As a reminder, unless David is excused from Jury duty, we will publish tomorrow’s update this evening.