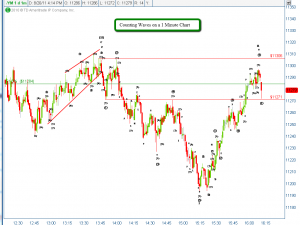

We are often asked “why count waves on a 1 minute chart, that seems like a lot of work?”. It does take time and it is work. However, after showing you in this video why we get down to the miniscule wave to look for low risk high reward opportunities, you might decide that it’s work that pays.

In this video, Kevin points out a potential low risk, high reward trade on the Emini-Dow that maybe ready to trade. Watch as Kevin uses Elliott Wave analysis to analyze the trade starting from a weekly chart and then zooms in to the 1 minute chart and shows why he thinks this has the potential to be a very profitable trade.

Who knows, after watching the video and later seeing the results , (in case you watch the video a few days later) you may be want to be like many others and subscribe to Elliott Squawk where Kevin and David provide you with daily video updates of the wave counts on the DJIA, YM, Euro and the Ten Year Treasury.

Kevin may miss the count on this one, but at least we know where to place the stop and minimize the risk for what has the potential to be a big reward if the count is right.

We hope you enjoy the video and see the advantages that using Elliott Wave analysis provides for more profitable trades.

No Responses to “Why Count Waves on a 1 Minute Chart?” Leave a reply ›