We are comfortable with our open positions after our first week managing the model portfolio. Our position short sugar futures was opened on Thursday and the dramatic drop increases the likelihood that the commodity is resuming its downtrend. Taking out mid-December lows will further add to this potential. Thursday’s sharp decline will also condition us to expect that bounces here are corrections. If the consolidation off of Thursday’s low gives way to a new low then it might set the stage for a larger bounce. Even so, if we have the correct interpretation of the pattern then this, too, will eventually yield to even lower prices before exceeding Wednesday’s highs. Therefore, we are keeping our stop above those highs and risk reward is still favorable .

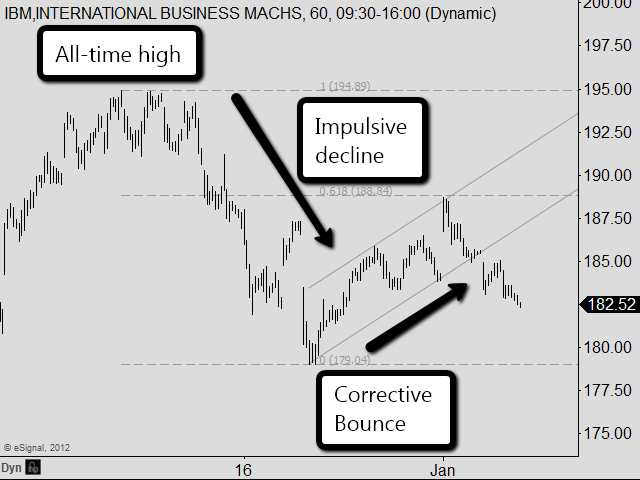

The pattern in IBM also supports the idea of lower prices and so we are comfortable positioned short through a long put position opened on Thursday. We find the setup for continued downward movement from the all-time high compelling for several reasons:

- The initial move down appears impulsive.

- A subsequent bounce appears corrective, retraced almost exactly 61.8% of the decline and has been contained within a channel.

- The channel eventually broke to the downside.

The position moved slightly back into profit on Friday. The worry with this position is that the DJIA has not convincingly shown that it is in a downtrend. IBM is significantly overweight in the index and, therefore, we would generally expect the two to move in tandem. Nevertheless, the IBM pattern is persuasive and we will stick with it unless our stop is taken or we see a rise that looks like it is developing as something more than a correction. This idea may be tested soon as the stock looks as if the leg down from Tuesday’s high might be mature. Ideally any immediate bounce is contained near the bottom channel line

IBM Hourly

As to the pattern in the DJIA, while it hasn’t yet confirmed a turn, we still anticipate that if a high isn’t already in that it might be soon. We attempted to enter short positions on Tuesday but were stopped out. As sometimes happens, the position would currently be in profit if we had held through the week. However, we need to allow our discipline to supersede possibility and we took our stops while losses could be contained. Once we can be more confident that a turn is in place we will look for trade setups which have attractive risk/reward characteristics.

We are stalking possible setups in several commodities including cotton, corn, and soy. These might take several weeks to mature and we’ll review them in more detail if they appear to hold promise of imminent trade setups.

The Managematics Model Portfolio is a fictitious portfolio managed to demonstrate trading techniques which may be used to trade a speculative account. It is for education purposes only. Nothing related to the portfolio should be interpreted as a recommendation to buy or sell any security and the general techniques employed may not be suitable for every individual. Past performance of these techniques or this portfolio may not be representative of future results. The results shown may vary from actual, live trading results which are subject to live market conditions.

No Responses to “Portfolio Review for Week Ending 1/6/2012” Leave a reply ›