Archive for the ‘Elliott Squawk’ Category

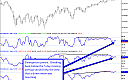

Squawk DJIA Briefing for 2/27/2012

Below is our evening update for the DJIA. Tomorrow morning we will update the outlook for the other markets we cover.

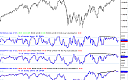

Squawk Morning Briefing: Disagreement and Divergence

Our analysis in different markets do not necessarily agree this morning. The most significant example is likely the difference between the DJIA cash index and its futures. This has happened before, and we make no apology when it does. In fact, we think it is valuable to know when there are […]

Squawk DJIA Briefing for 2/24/2012

Below is our evening update for the DJIA. Tomorrow morning we will update the outlook for the other markets we cover.

Squawk Morning Briefing: Filling In

Today it’s Kevin’s turn to have computer issues so David is filling in. That has added a few minutes to the time to prepare today’s briefing and since the analysis shows some potentially pivotal action today we’ll get straight to the analysis without further comment.

Squawk DJIA Briefing for 2/23/2012

Below is our belated update for the DJIA. We will be back on schedule this evening.

Squawk Morning Briefing: The Detroit Lions Trade

News out of Europe continues to suggest weakening conditions, although today this was mostly unrelated to Greece. PMI data fell short of expectations and the Bank of England voted to inject more monetary stimulus into its economy. While that may have some traders giddy expecting more of a cheap money sugar high, what […]

Squawk DJIA Briefing for 2/22/2012

Below is our evening update for the DJIA. Tomorrow morning we will update the outlook for the other markets we cover.

Squawk Morning Briefing: Will Europe Make Waves?

Trade continues to react to the situation in Europe with “buy the rumor and sell the news” playing out again. European equities and most risk assets rose on Monday and declining again so far today. That still leaves U. S. equity futures and other positively correlated instruments slightly above Friday’s close, just […]

Squawk DJIA Briefing for 2/21/2012

Below is our evening update for the DJIA. Tomorrow morning we will update the outlook for the other markets we cover.

Squawk Morning Briefing: Keep Us Honest

We’ll repeat what we have said before: until we see impulsive action to the downside, we have have not begun a turn down. It is easy to remind ourselves of that after we see prices reverse upward in the short-term. Hopefully we also emphasize the same message when considering a turn down. Markets still seem […]