Archive for the ‘Elliott Squawk’ Category

Squawk Morning Briefing: Overbought? Understaffed?

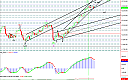

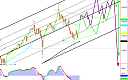

It’s hard to call Tuesday’s pause a sell-off with the DJIA losing just 1/10 of one percent, but it was a pause in a string of up days that has created an overbought condition that we now need to work off. Our wave counts don’t require any correction to happen now. Corrections could still be […]

Squawk Morning Briefing: Fireworks or Dud?

Last year, the July 4th holiday launched markets upward to a new recovery high. This year, the bounce may have gotten an early start. Following Friday’s action, it is now less likely that the top is in and we need one more recovery high before a change in trend to the downside. These were among […]

Squawk Morning Briefing: Enjoy Your Holiday Weekend

Wave counts could allow for continued upside action in the equity indices before a turn back down, either with or without a meaningful fourth wave. This is consistent with an upward bias seen before long holiday weekends and also seen on the first of the month with mutual fund inflows. Nevertheless, at some point the […]

Squawk Morning Briefing: Industrial Activity Retakes Stage

With the Greece vote out of the way, attention can return to the U. S. economy and economic activity. Chicago PMI comes out today and could show weakness if it follows the lead of regional Fed reports. We noted earlier in the week that the Dallas Fed number was particularly bad. Historically, this number has […]

Squawk Morning Briefing: Uncertainty Abounds

Greek austerity measures passing wasn’t much of a surprise, but we still need to wait for the open to gauge to true raction of markets. There have been some wild swings so far.

We hope to see subscribers at our webinar today.

Squawk Morning Briefing: Greece Fire?

It sure is hard to put out a grease fire and it looks to be just as difficult to suppress the conflagration in Greece as protesters are vehement in their opposition to EU enforces austerity measures. Markets have shown that they react to this situation so we might expect a significant move tomorrow. The real […]

Squawk Morning Briefing: Is It Fall Yet?

Summer action can get slow. Add to that the indecisive action in the markets and it’s a tough trade right now. The changing of the seasons is predictable, but what we really want to anticipate is a fall in the markets. For some time we’ve been allowing for another high to be seen first and […]

Squawk Morning Briefing: Running Late

We’re sorry that today’s briefing is later than usual today. We’ll direct you straight to the videos for our thoughts. Have a great weekend!

Squawk Morning Briefing: Disappointed Fed Doesn’t Disappoint

In its written statement and in comments by Chairman Bernanke, the Fed expressed disappointment at the pace of the U.S. recovery. Even though they expressed their belief that many for the drags on GDP would be temporary they lowered their 2011 and 2012 forecasts. Once again, the FOMC came through and delivered what many traders […]

Squawk Morning Brieifing: FOMC Day

Traders in bond, equity, and currency markets are all watching for some sign from the Federal Reserve so the results of today’s meeting and the press conference that follows may introduce some volatility. We want to see if that moves that follow help to clarify our wave counts. We’ll get straight to the videos to […]