Archive for the ‘Newsletters’ Category

Squawk Morning Briefing: Will You Still Save Me Tomorrow?

With Greece saved, markets maintained an uptrend last week. The move continues to appear weak for all the reasons we have cited, but a trend is a trend until it isn’t. So that doesn’t mean that the market needs good news in order to retain its current direction, but it does cause us […]

Squawk DJIA Briefing for 2/27/2012

Below is our evening update for the DJIA. Tomorrow morning we will update the outlook for the other markets we cover.

Squawk Morning Briefing: Disagreement and Divergence

Our analysis in different markets do not necessarily agree this morning. The most significant example is likely the difference between the DJIA cash index and its futures. This has happened before, and we make no apology when it does. In fact, we think it is valuable to know when there are […]

Squawk DJIA Briefing for 2/24/2012

Below is our evening update for the DJIA. Tomorrow morning we will update the outlook for the other markets we cover.

Squawk Morning Briefing: Filling In

Today it’s Kevin’s turn to have computer issues so David is filling in. That has added a few minutes to the time to prepare today’s briefing and since the analysis shows some potentially pivotal action today we’ll get straight to the analysis without further comment.

Squawk DJIA Briefing for 2/23/2012

Below is our belated update for the DJIA. We will be back on schedule this evening.

Squawk Morning Briefing: The Detroit Lions Trade

News out of Europe continues to suggest weakening conditions, although today this was mostly unrelated to Greece. PMI data fell short of expectations and the Bank of England voted to inject more monetary stimulus into its economy. While that may have some traders giddy expecting more of a cheap money sugar high, what […]

Squawk DJIA Briefing for 2/22/2012

Below is our evening update for the DJIA. Tomorrow morning we will update the outlook for the other markets we cover.

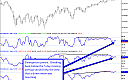

Discussion of RL Trade Setup

Last week the model portfolio took a short position in RL. This is a setup based on the Elliott wave ending diagonal pattern. The ending diagonal pattern is one or the complex and specific patterns that exist. In other words many more rules need to be satisfied to create a possible ending diagonal than any […]

Squawk Morning Briefing: Will Europe Make Waves?

Trade continues to react to the situation in Europe with “buy the rumor and sell the news” playing out again. European equities and most risk assets rose on Monday and declining again so far today. That still leaves U. S. equity futures and other positively correlated instruments slightly above Friday’s close, just […]