Archive for the ‘Newsletters’ Category

Squawk Morning Briefing: Step Aside

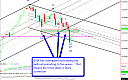

It is not always the case that when our wave counts are indecisive then the markets are, too. But that seems to be the case now with multiple possible scenarios and the DJIA up over 100 points one day and down well over 200 the next. Our analysis continues to tell us that we don’t […]

Squawk Morning Briefing: Contradictions

By the time you read this briefing, it is likely that the monthly ADP report will be released setting expectations for the May Nonfarm Payroll numbers released on Friday. Traders who pay attention knew these numbers were coming since they occur the same time each month. Furthermore, expectations may be for a weak number since […]

Squawk Morning Briefing: Sell in May; Buy in June?

U. S. equity indices remain below their early May highs, giving credibility to historical market wisdom which suggests, “sell in May.” However, those who are tracking our analysis know that we’re not convinced that a top is in and remain open to the notion of a new recovery high before a sustained turn lower. If […]

Squawk Morning Briefing: Have a Great Holiday Weekend

Markets will be closed on Monday so our next briefing will be on Tuesday morning. Trading is likely to be light on Friday and therefore may be unpredictable. So we won’t have any comments other than our daily briefings on specific markets below.

Squawk Morning Briefing: News Matters Again

This morning we expect to receive a first revision to first quarter GDP numbers as well as weekly jobless claim figures. Continuing with our view that news events tend to push markets into the direction of the wave count they are following, we will see if the reaction to the news reveals the current direction. […]

Squawk Morning Briefing: Slowly I Turn…

In our seemingly endless series of writings on Elliott waves and market tops, today we will once again mention that we seem to be observing topping action. One of the hallmarks is three-wave movement in both directions after an extended run. However, we will also once again caution that topping action does not mean that […]

Squawk Morning Briefing: Sloppy Action Continues

While our most likely case for the DJIA is to look for more highs, the sloppy action we continue to see suggests that it could be a choppy move to new highs. That means that even if we do get the new high, it doesn’t feel like a high probability trade. Add to that the […]

Squawk Morning Briefing: Videos and Voices

David’s voice isn’t back 100%, but good enough to record videos again so we have videos from both David and Kevin again today.

Squawk Morning Briefing: Look to Bonds

There remains plenty of uncertainty to shake out in the equity markets, but the treasuries are looking like they have a better trade setting up. Check it out in today’s briefing.

Squawk Morning Briefing: Don’t Compound Pain

It is painful to the market move and not take part in it. Wednesday’s action seems to increase the odds that U. S. equities will see another high before any turn. However, it’s also a good bet that it won’t be a straight path and we’re likely to remain in a choppy environment where the […]