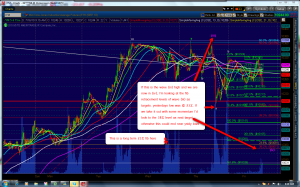

Quite often I find it useful to revisit the big picture to revisit some prior counts in view of the near term differences. I have made some adjustments to my longer term chart to explore some alternate counts.In light of the sharp correction we have had to this point, the above chart looks very possible that we are in a larger Minor wave 2, with Minor wave 1 as a leading diagonal. If so, we may be in the process of finishing the [a] wave of a zig-zag 5 wave move up from the July 2 lows.

Quite often I find it useful to revisit the big picture to revisit some prior counts in view of the near term differences. I have made some adjustments to my longer term chart to explore some alternate counts.In light of the sharp correction we have had to this point, the above chart looks very possible that we are in a larger Minor wave 2, with Minor wave 1 as a leading diagonal. If so, we may be in the process of finishing the [a] wave of a zig-zag 5 wave move up from the July 2 lows.

This count labels the wave (iii) highs at the overnite highs of Wed. at 10,365. This level is also a 5o% retracement level of the Oct 07 highs as well as the 50% retracement levels from the April 26 high..interesting how a combination of fibs coincide to provide important price levels support and resistance. If this count is correct we are now in wave (iv) of [a]. An important price level to look for is at a 38% retracement of (iii) at 10,0071. Since lots of volatility occurs on Opex days, we will watch for a strong move up from near this level. If so, this could lead us to finish wave (v) where I would be looking at the “snowline” which is just short of the June 21 high at 10,536 which I have labeled as wave[iv].

One Response to “Early Morning Outlook” Leave a reply ›

Nice Call Kevy! Closed at 10,062.