Squawk Morning Briefing: Looks Like A Topping Process

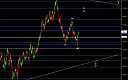

Traders say it all the time, “topping is a process,” and the action we’re seeing now looks a lot like one of those processes. That suggests that we could continue to see choppy action here but with an overall positive bias until we see more of a completed move to the upside in the […]

Squawk Morning Briefing: Stay Nimble Or Stay Patient

This remains a tricky spot with many potential outcomes. Except for the most nimble of short-term traders, this is a good place to sit and watch as we wait for additional clues about the long-term trend. Remember, that the dominant trend remains up until we prove otherwise but that we look tired and […]

Squawk Morning Briefing: Choppy Moves in Both Directions

Choppy three-wave moves both up and down keep us on our toes although they suggest that any significant move down might still be waiting to arrive.

Squawk Morning Briefing: NFP Shows Tired Market

The pop and drop seen in U. S. equities following Friday’s non-farm payroll report continues to demonstrate how weak the advance is in U. S. equities. That continues to suggest that the upside will be challenged without some pullback first. There are still many scenarios for how things might play out from here […]

Squawk Morning Briefing: Sorting Out Scenarios

Today’s non-farm payroll report is likely going to set the tone for the day and will hopefully help sort out which Elliott wave scenario the market is following in the near term.

Squawk Morning Briefing: Looking Tired

The DJIA made a new all-time closing high on Wednesday after closing above its December 31st level; it is still modestly below it’s all-time intraday high recorded in early April. The S&P 500 has also rallied to near all-time highs but trades slightly below them.

Our base case still expects to see new […]

Squawk Morning Briefing: News Might Move Things

Little movement on Tuesday and little movement overnight leaves it up to this morning’s reports to try and spur markets to move one way or the other. Both the ADP and GDP reports have the ability to create significant movement, as does this afternoon’s announcement at the conclusion FOMC meeting.

Squawk Morning Briefing: Bullish Suggestions

As stretched as we were yesterday morning we got even more extended through the day with the S&P 500 spiking below just below the Voodoo Treeline before recovering. This is exactly the level which needed to hold and the bounce from that level has us continuing to look upward. Because of the depth […]

Squawk Morning Briefing: Stretched Count

Friday’s action to the downside stretches the limits of our fourth wave correction count in U. S. equities but at this level we can say it is bent but not broken. Overnight strength in futures suggests that our view from last week still works at the start of this week.