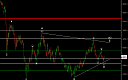

S&P Alternate 1

This is an alternate view

Squawk Morning Briefing: Consolidation

Thursday saw trade in U. S. equities remain within their recent range. The best interpretation is that this represents consolidation before continuation in the direction of the dominant trend. More details in today’s videos.

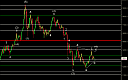

Squawk Morning Briefing: New Highs In Sight

Wednesday saw consolidation in U. S. equities as the S&P 500 sits just below all-time highs. We don’t expect the current move up to end until it reaches new highs and it completes a five-wave move. It is easy to discern when a new all-time high is hit and the conditions for completing […]

Squawk Morning Briefing: Looking Up For Now

On Tuesday, the S&P 500 finally achieved the last of the milestones we wanted to see to convince us that it is likely to register a new all-time high before any up move is complete. This is only the last of several milestones so we had an early warning. Today’s videos discuss the […]

Squawk Morning Briefing: Nothing Changed

After a day of trading on Monday the situation in U. S. equities remains tricky and for exactly the same reasons. In short, not much has changed since yesterday but we review the situation in today’s videos in any case.

Squawk Morning Briefing: Deceptively Tricky Action

At first blush, it appears that Thursday’s buying occurred on relatively good volume — toward the upper end of what we’ve seen in recent weeks. So despite somewhat choppy buying, that might suggest that the up move has some real buyers behind it. But that bullish optimism needs to be tempered by the […]